If investing were a cooking show, raw returns would be the glamour shot: sizzling, shiny, and sometimes wildly misleading.

Risk-adjusted returns are the boring (but crucial) part where someone quietly reads the recipe and asks, “Okay, but how likely is this to set the kitchen on fire?”

The point isn’t to kill the fun. The point is to make sure your portfolio doesn’t become a surprise reality show called “I Didn’t Know That Could Happen.”

Risk-adjusted returns try to answer a simple question: How much return did you get for the risk you took?

That sounds obviousuntil you realize “risk” is a slippery word. Sometimes it means volatility. Sometimes it means downside losses.

Sometimes it means “I will panic-sell at the exact worst moment and then pretend it was a strategic decision.”

So yes, risk-adjusted returns matter… but only if you use them like a dashboard, not like a crystal ball.

What Are Risk-Adjusted Returns, Really?

A risk-adjusted return measure takes an investment’s return and compares it to some measure of risk.

The goal is to compare apples to apples: if two investments earn similar returns, the one that got there with less drama (less risk) generally “wins.”

This is especially useful when you’re comparing:

- Two mutual funds with different styles

- An active manager vs. an index fund

- A stock-heavy portfolio vs. a more balanced portfolio

- Strategies that look great on paper but feel awful in real life

The catch: the most common “risk” input is volatility (how much returns bounce around), which is not always the same thing as the risk that matters most to you.

A low-volatility investment can still have other risks (inflation risk, credit risk, liquidity risk, concentration risk, “oops” risk).

And a higher-volatility investment can be perfectly reasonable if your time horizon is long and you can stick with it.

Why People Love Risk-Adjusted Metrics (and Why They Should Chill a Little)

Investors love numbers because numbers feel like certainty. The Sharpe ratio has a crisp formula and an even crisper vibe:

“I have quantified my portfolio. I am now basically a hedge fund.”

But risk-adjusted metrics are best used for comparison and contextnot for declaring a single “best” investment forever.

What risk-adjusted returns can help you do

- Compare strategies: Especially when returns are close but the ride is different.

- Spot “free lunch” illusions: Some returns come from hidden risk that shows up later.

- Evaluate consistency: Not just “how much,” but “how reliably.”

- Match a portfolio to behavior: The best portfolio is the one you can actually hold.

What risk-adjusted returns cannot do

- Predict the future: They’re backward-looking. Markets do not sign contracts.

- Capture every kind of risk: Especially tail risks, liquidity, and “this was fine until it wasn’t.”

- Replace common sense: A gorgeous ratio can still come from an investment that doesn’t fit your goals.

The Big Three (Plus a Few Extras) of Risk-Adjusted Return Metrics

1) Sharpe Ratio: The Classic “Return per Unit of Volatility”

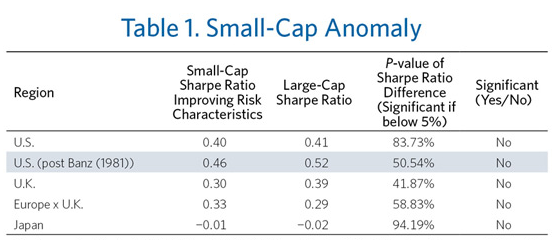

The Sharpe ratio compares an investment’s excess return (return above a risk-free benchmark) to the volatility of those returns.

In plain English: How much extra reward did you get for the bumpiness you endured?

A higher Sharpe ratio generally suggests better risk-adjusted performance, all else equal. It’s widely used because it’s simple and comparable across funds and portfolios.

But it treats upside volatility and downside volatility the samemeaning it “penalizes” an investment for going up too enthusiastically.

Which is kind of like scolding someone for laughing too loudly at a comedy show.

2) Sortino Ratio: Sharpe’s Cousin Who Only Worries About the Bad Stuff

The Sortino ratio focuses on downside volatilityreturns falling below a target or minimum acceptable return.

It’s useful when you want a metric that aligns more closely with how humans experience risk:

we don’t usually lose sleep because our portfolio went up “too much.”

Sortino can be especially helpful when comparing strategies with “lumpy” upside (like trend-following or certain alternatives),

because it doesn’t punish positive surprises the way Sharpe can.

3) Information Ratio: “Did You Beat the Benchmark… Efficiently?”

The information ratio compares excess returns over a benchmark to the tracking error (how much the investment deviates from that benchmark).

If Sharpe is about “reward per volatility,” information ratio is more like “reward per active risk.”

For active managers, this is often the more honest scorecard.

It asks: If you’re going to be different than the index, did that difference actually pay off?

Other common tools (useful, but don’t marry them)

- Standard deviation: A basic volatility measure. Great for context, limited for capturing “real” risk.

- Beta: Sensitivity to market movements (market risk). Useful, but not the whole story.

- Maximum drawdown: How bad the worst peak-to-trough decline was. Very “felt” risk.

- Jensen’s alpha / Treynor ratio: More advanced ways to interpret returns relative to market risk.

A Wealth of Common Sense Take: Yes, But Don’t Worship the Ratio

A key insight you’ll see in thoughtful investing commentary is that risk-adjusted returns can become a trap if you treat volatility as the only risk that matters.

For example, a bond fund may look “better” on a Sharpe ratio because bonds typically have lower volatility than stocks.

But lower volatility often comes with lower long-term expected returnso the “best” Sharpe ratio might quietly guide you into a portfolio that won’t meet your goals.

This is why risk-adjusted returns matter in context:

they are a measuring tool, not a mission statement.

The mission statement is still your goal: retirement income, a house down payment, funding college, building generational wealth, or simply not panicking in every market headline.

Specific Examples: When Risk-Adjusted Returns Help (and When They Mislead)

Example 1: Two funds earn 8%but one makes you miserable

Imagine Fund A and Fund B both average 8% annual returns over five years.

Fund A is steady-ish; Fund B is a roller coaster.

Risk-adjusted metrics can reveal that Fund A delivered the same return with less volatility or smaller drawdowns.

For many investors, Fund A is the superior choicebecause it’s the one they can actually hold through a rough year.

Example 2: The “High Sharpe, Low Goal Achievement” problem

Now imagine a conservative bond-heavy strategy with a strong Sharpe ratio.

It might look fantastic on risk-adjusted metrics, but if your goal requires higher long-term growth,

this is like choosing the safest car in the world… for a cross-country road trip where it tops out at 35 mph.

You’ll arrive safelynext decade.

Example 3: Active manager evaluation with the information ratio

Suppose an active fund claims it can beat the S&P 500.

The information ratio asks: did the manager consistently add value beyond the benchmark relative to the extra risk they took by deviating from it?

If the fund sometimes beats the market but does so erratically with high tracking error, you may be paying a premium for inconsistency.

Volatility Isn’t the Only Risk (And Sometimes It’s Not the Main One)

Volatility is visible and measurable, which is why it’s used so often. But the risk that matters can be different depending on what you’re doing:

- Time-horizon risk: Needing money in two years means volatility is a bigger problem than if you’re investing for 25 years.

- Inflation risk: Low-volatility assets can still lose purchasing power quietly and consistently.

- Credit risk: Some “steady” income strategies take hidden credit risk that shows up during stress.

- Liquidity risk: If you can’t sell at a fair price when you need to, the ratio won’t save you.

- Behavioral risk: The portfolio you abandon is the portfolio that fails.

This is why many professionals treat risk-adjusted metrics as one layer of analysis:

useful, but not sufficient.

How to Use Risk-Adjusted Returns the Smart Way

Step 1: Start with goals, not ratios

Before you compare Sharpe ratios, decide what “success” means for you. Are you trying to maximize long-term growth?

Protect principal? Generate income? Reduce drawdowns? The best risk-adjusted investment for one goal can be the wrong tool for another.

Step 2: Compare like with like

Risk-adjusted metrics work best when comparing similar categories or strategies across the same timeframe.

Comparing a short-duration bond fund’s Sharpe ratio to a small-cap growth fund is like comparing a bicycle’s safety rating to a jet ski’s fuel economy.

Both have numbers; only one comparison makes sense.

Step 3: Use multiple metrics

Pair Sharpe with Sortino and max drawdown. Add information ratio for benchmark-relative evaluation.

Look at standard deviation and downside capture. No single metric tells the whole story, but a group of them can.

Step 4: Check the “why” behind the number

A strong risk-adjusted profile can come from genuine diversification and disciplineor from hidden risks that haven’t shown up yet.

Look at holdings, concentration, turnover, and how the strategy behaved in stressful markets.

If it looks too smooth, ask what’s under the hood.

Step 5: Match the portfolio to your stomach

A portfolio’s “best” risk-adjusted return is irrelevant if you can’t stick with it.

The true enemy of performance is often not fees, not inflation, not even taxes.

It’s the moment you sell after a drop because your emotions staged a coup.

Do Risk-Adjusted Returns Matter? The Practical Answer

Yesrisk-adjusted returns matter because they help you evaluate whether returns were earned efficiently, consistently, and in a way you can live with.

They’re especially valuable for comparing funds, evaluating active strategies, and understanding tradeoffs between “more return” and “more turbulence.”

But they don’t replace common sense. They don’t capture every risk. They don’t guarantee future results.

And they can lure investors into overly conservative choices if interpreted without goals in mind.

Use them as a flashlight, not as a GPS.

Field Notes: of Real-World Experiences Investors Run Into

Here are a few real-world patterns investors commonly experience when they start paying attention to risk-adjusted returns (and what they learn along the way).

Think of these as “portfolio life lessons” that show up whether you asked for them or not.

Experience 1: The “I Found the Best Sharpe Ratio!” phase

Many investors discover the Sharpe ratio and immediately go hunting for the highest number.

The first surprise is that the “winner” is often a lower-volatility fundsometimes a bond-heavy or defensive strategy.

It feels comforting, like switching from a sports car to a minivan with five-star safety ratings.

Then comes the second surprise: the minivan doesn’t win many races.

Over long periods, an ultra-defensive approach can reduce the emotional pain of drawdowns, but it can also reduce the probability of meeting big long-term goals.

The lesson: a great risk-adjusted return does not automatically mean a great life-adjusted return.

Experience 2: “Volatility didn’t hurt mepanic did”

Investors often learn that volatility is not just a statistic; it’s a test of behavior.

A portfolio might have strong long-term expected returns, but if it regularly drops 20%–30% and the investor sells at the bottom,

the realized return becomes a tragic remake of a classic: Buy High, Sell Low: The Musical.

Risk-adjusted thinking can help here because it reframes the conversation:

instead of asking “What returned the most?” the investor asks “What can I hold through an ugly year without self-sabotage?”

That shift alone can improve outcomes more than finding the “perfect” fund.

Experience 3: The benchmark wake-up call

Some investors pay active management fees for years and only later compare performance to a simple benchmark.

When they do, risk-adjusted metrics like the information ratio can be eye-opening.

An active fund may have occasional bursts of outperformance, but if those wins come with large deviations and inconsistent results,

the investor realizes they were paying for excitement, not skill.

The lesson: if you’re going to be different than the index, you want to be different in a way that consistently adds valuenot just in a way that tells a good story at parties.

Experience 4: The “hidden risk” discovery

Investors sometimes find strategies that look unusually smoothgreat risk-adjusted numbers, minimal drawdowns, steady performance.

Then a market stress event hits, and the strategy behaves in a way the historical stats didn’t prepare them for:

liquidity dries up, correlations spike, or a concentrated bet finally shows itself.

This is when investors learn that risk isn’t always visible in standard deviation.

It can live in leverage, credit exposure, derivatives, or simply the assumption that the future will resemble the past.

The lesson: risk-adjusted returns are a starting point for questions, not an ending point for conclusions.

Experience 5: The calm confidence of a “good enough” process

The best long-term outcome many investors report isn’t a magical metricit’s clarity.

They settle on a diversified, low-cost portfolio aligned with their time horizon and risk tolerance.

They use risk-adjusted measures occasionally to sanity-check changes, not to constantly chase optimization.

Over time, they stop treating investing like a game of perfect decisions and start treating it like a discipline:

consistent contributions, sensible rebalancing, and fewer emotional decisions.

The lesson: the most powerful risk adjustment is often the one applied to your own behavior.

Conclusion

Risk-adjusted returns matter because they help you understand the tradeoff between reward and the bumps you had to endure to get it.

Use them to compare similar investments, evaluate active management, and build a portfolio you can stick with.

Just don’t let a single ratio bully you into ignoring your goalsor trick you into thinking you’ve solved investing with one spreadsheet column.

The best portfolio isn’t the one with the prettiest metrics. It’s the one that helps you reach your goals while letting you sleep at night.