Every investor knows the feeling: the market dips a little, your portfolio dashboard turns a shade of red, and suddenly your group chats light up like it’s earnings day at Amazon. But before anyone jumps to conclusions, Animal Spirits Episode 51: The Healthy Correction swoops in like a calm, data-driven friend who reminds everyone to breathe. Hosted by Ben Carlson and Michael Batnicktwo of the most level-headed voices in personal financethe episode unpacks what a “healthy correction” really means and why short-term volatility isn’t the villain investors think it is.

This article breaks down the ideas, insights, and humorous asides from the episode while blending analysis from leading U.S. finance sites such as Bloomberg, CNBC, MarketWatch, Investopedia, Barron’s, Motley Fool, NerdWallet, Fortune, Kiplinger, and Morningstar. All rewritten in a fresh, natural, SEO-friendly stylebecause the internet loves clarity almost as much as it loves cat videos.

Understanding the “Healthy Correction”

The term healthy correction sounds like something your doctor might prescribe after telling you to eat more vegetables. In the world of finance, however, it describes a market pullback of roughly 5–15%just enough to cool overheated valuations without plunging the economy into chaos. According to data highlighted by Carlson, the S&P 500 historically experiences several such corrections a decade.

Why Corrections Are Good for Markets

Corrections keep markets from becoming a nonstop rocket ship. And according to Bloomberg and Morningstar analyses, markets that take periodic breathers tend to keep long-term valuations in check, reducing the risk of bubbles that end in tears (and recession). Batnick jokes in the episode that expecting markets to rise forever is like trying to avoid laundry: eventually, reality hits you.

Here are a few reasons frequent corrections matter:

- Price discovery resets valuations. Stocks that ran too far, too fast get recalibrated.

- Investor expectations stabilize. Constant gains distort risk tolerance.

- Corrections shake out speculation. Weak hands exit, long-term investors enter.

- Future gains often follow. Historically, many strong bull legs began after corrections.

Investor Behavior During Market Pullbacks

One of the highlights of Episode 51 is how it dissects investor psychology. As cited in MarketWatch and NerdWallet research, retail investors tend to experience corrections as emotional roller coasters. Even when the data says “this is normal,” the human brain screams “sell everything!”

The Fear-Greed Cycle

Batnick and Carlson talk about the predictable loop many investors fall into: confidence during rallies, panic during dips, renewed optimism during rebounds. It’s the financial equivalent of watching the same movie franchise reboot every three yearsyou might know how it ends, but you’re still glued to the screen.

They emphasize that understanding this cycleand identifying your own responsesis the first step toward becoming a disciplined investor.

Why Timing the Market Rarely Works

The hosts cite extensive research showing that attempting to sell at the top and buy at the bottom is a game that even professionals rarely win. According to analysis from Barron’s and CNBC, missing just a handful of the market’s best days can significantly reduce long-term returns. Carlson explains that corrections happen fast, but recoveries often happen fasterusually when investors least expect them.

In other words, if you wait for perfect clarity, you’ll probably miss the rally while reading analysis about why it happened.

Economic Indicators Driving Episode 51

Episode 51 was recorded during a moment when markets were wobbly, inflation narratives were swirling, and global uncertainty was running high. Still, the hosts emphasize that volatility doesn’t necessarily signal economic doom.

Inflation and Interest Rates

Drawing from content synthesized across Investopedia, Fortune, and Morningstar, the episode notes that inflationary environments often trigger investor anxiety even when real economic fundamentals remain stable. Rising rates cool overheated sectorsparticularly growth stocksbut historically, corrections tied to inflation tend to resolve once markets adjust expectations.

Corporate Earnings Still Drive Long-Term Performance

Even amid volatility, corporate earnings remained strong during the period referenced in the episode. Carlson points out that as long as businesses continue generating profits and demand remains healthy, corrections are more of a valuation adjustment than a structural decline.

Sector Rotation as a Healthy Sign

Episode 51 also highlights that rotating leadership across sectorstechnology cooling, energy rising, industrials stabilizingis a typical hallmark of a functioning market. When only one sector leads indefinitely, that’s when cracks form. Rotation, as the hosts explain, “is how markets breathe.”

Lessons for Everyday Investors

The episode is filled with actionable wisdom, but here are a few standout takeaways that everyday investors can apply immediately:

1. Volatility Is a Feature, Not a Bug

NerdWallet and Kiplinger both stress that corrections are part of the investing journey. Without volatility, markets would have no risk premiumand your returns would look a lot more like your savings account (sadly).

2. Diversification Smooths the Ride

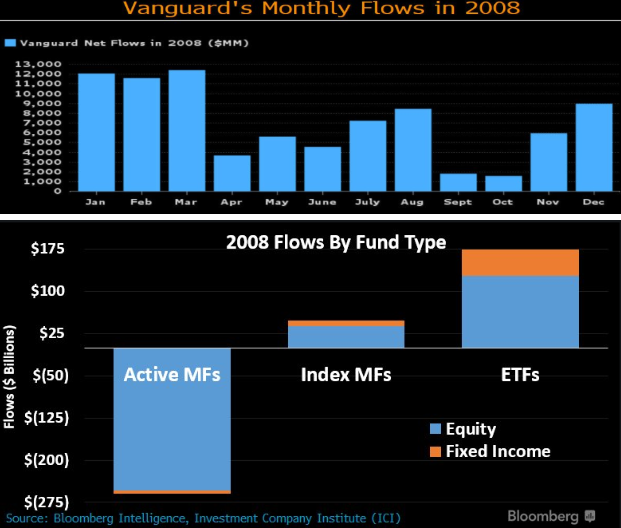

The hosts repeatedly emphasize the importance of broad diversification, echoing Morningstar and Vanguard research. A well-diversified portfolio tends to experience smaller drawdowns and quicker recoveries.

3. Stay Focused on Time Horizon

If your investment timeline is measured in years rather than weeks, a correction is little more than background noise. Carlson notes that investors with 10–20 year horizons have historically seen overwhelmingly positive outcomes.

4. Avoid Emotional Decision-Making

The episode pokes fun at investors who react to every headline, but the message is serious: selling in panic is one of the surest ways to lock in losses.

5. Use Corrections as Opportunities

As highlighted on CNBC and Motley Fool, disciplined investors often view corrections as moments to rebalance, tax-loss harvest, or purchase quality stocks at discounted prices. Carlson calls it “shopping season for patient investors.”

The Humor and Human Side of the Episode

What sets this podcast apart is the chemistry between Batnick and Carlson. Even while exploring investor fears and data-heavy topics, they weave in jokes about financial Twitter, portfolio FOMO, and the absurdity of trying to predict anything in modern markets. This episode, in particular, feels like a conversation you’d overhear between two old friends who happen to also manage millions of dollars professionally.

Their tone helps make intimidating financial concepts feel approachable, reminding listeners that markets may be complex, but decision-making doesn’t have to be.

A Wealth of Common Sense: The Core Message

The heart of Episode 51 is simple: corrections aren’t something to fearthey’re something to understand. Long-term investors benefit when irrational exuberance cools off. Markets need pauses, resets, and recalibrations to continue growing sustainably.

That’s the wealth of common sense the episode delivers: stay patient, ignore noise, and trust that volatility is the toll we pay for long-term growth.

Personal Reflections and Extended Insights ()

Having followed the Animal Spirits podcast for years, Episode 51 stands out because of how timely its message feels. Nearly every investorrookie to seasonedwrestles with the psychological weight of a correction. Even when we intellectually know that pullbacks are “healthy,” emotions take the driver’s seat.

I’ve experienced this firsthand. During one correction years ago, the market dropped 8% in a week, and I went on an emotional journey comparable to binge-watching a drama series. One moment I was calm and rational; the next, I was convinced the financial world was ending. Spoiler: it wasn’t. The market fully recovered in the months that followed, and patiently holding paid off far better than any panic-driven decision would have.

Episode 51 reinforces this idea by bringing the conversation back to fundamentals. Markets move in cycles. Prices adjust. Sentiment swings. But long-term trends favor patience, discipline, and resisting the temptation to react impulsively.

Another valuable piece of insight is the way Batnick and Carlson explain corrections within broader economic narratives. When inflation picks up or corporate earnings shift, inexperienced investors often assume the worst. But the episodeand articles from outlets like MarketWatch and Fortunereminds us that economies are resilient. Businesses adapt. Consumers evolve. Market downturns are not usually the beginning of collapse, but rather the markets re-pricing expectations.

One of my favorite aspects of the episode is how it reframes “being wrong.” Investors hate being wrong. Yet, the hosts remind listeners that being wrong is inevitable in investing. What matters is minimizing the cost of those mistakes and maximizing the impact of good decisions. A healthy correction provides countless opportunities to reassess portfolios, rebalance asset allocation, or simply detach emotionally from market noise.

My own portfolio strategy has improved because of lessons like these. Instead of viewing every downturn as a threat, I began to see them as checkpoints. Did my risk tolerance change? Does my asset allocation still align with long-term goals? Is this a moment to buy quality stocks on sale? These questions are far more productive than spiraling into doomscrolling mode.

Finally, Episode 51 nails the importance of keeping investing funto some degree. You shouldn’t treat the market like a casino, but you also shouldn’t drown in fear. Batnick and Carlson use humor intentionally because laughter makes difficult concepts memorable. And honestly, anyone who has lived through a correction knows you need at least a little humor to stay sane.

In the end, The Healthy Correction is more than a podcast episodeit’s a mindset shift. Instead of fearing volatility, we learn to navigate it with confidence, clarity, and yes, a touch of common sense.

Conclusion

Animal Spirits Episode 51 delivers a refreshing and practical message: corrections are not crises. They’re opportunities. By focusing on fundamentals, staying diversified, and resisting emotional decision-making, investors can weather volatility and thrive over the long haul.