If you’ve ever stared at your bank app wondering, “Okay, but how did they get that interest number?”, you’re not alone. The good news: calculating interest on a savings account is way less scary than your last math exam. Once you understand a few basic formulas and how banks use APY, compounding, and simple interest, you’ll be able to double-check your earnings, compare high-yield savings accounts, and actually know what your money is doing while you sleep.

This guide walks you through simple and compound interest, explains APY in plain English, and gives you 15 clear steps (with examples) to calculate interest on a savings account like a pro. We’ll finish with some real-world experiences and tips so you can put the math to work in your daily financial life.

1. Savings Account Interest 101

When you put money into a savings account, you’re basically lending your cash to the bank. In return, the bank pays you interest. That interest is usually quoted in terms of an annual percentage yield (APY) or an interest rate. The higher the APY, the more your money earns over a year.

At the simplest level:

- Principal (P): The amount of money you deposit.

- Rate (r): The annual interest rate, usually written as a percentage but used as a decimal in formulas (for example, 4% = 0.04).

- Time (t): How long the money stays in the account, usually in years.

With simple interest, you earn interest only on your original deposit. With compound interest, you earn interest on your deposit plus the interest that’s already been added. Most modern savings accounts use compound interest, often daily, and show you the APY so you can see the total effect over a year.

2. Simple Interest: The “Training Wheels” Version

2.1 The Simple Interest Formula

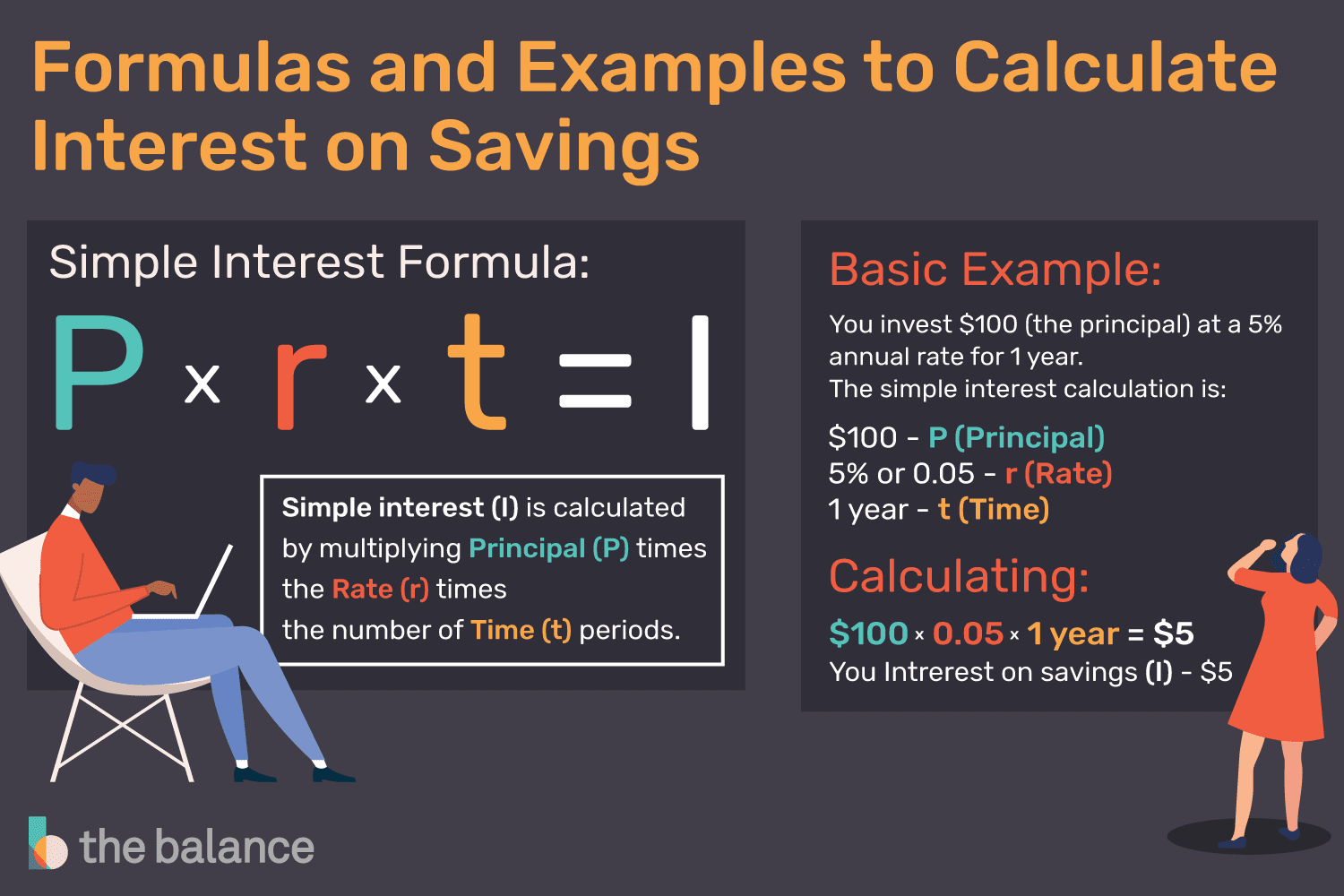

Simple interest is calculated using this formula:

Interest = P × r × t

- P = principal (your starting balance)

- r = annual interest rate (as a decimal)

- t = time in years

Example: You put $1,000 into a savings account that pays 4% simple interest per year, and you leave it alone for 1 year.

P = 1,000

r = 0.04

t = 1

Interest = 1,000 × 0.04 × 1 = 40

End-of-year balance = $1,000 + $40 = $1,040.

With simple interest, every year is the same $40. No surprises, no drama.

2.2 When Simple Interest Is Useful

Most savings accounts don’t actually use simple interest, but the formula is still handy for:

- Quick mental estimates of what you might earn.

- Understanding the basic relationship between rate, time, and principal.

- Comparing low-interest accounts where compounding doesn’t change much over short periods.

3. Compound Interest: Where the Magic Happens

Compound interest is where your money really starts to work for you. Here, the bank adds interest to your balance regularly (daily, monthly, quarterly, etc.), and the next interest calculation is based on this new larger balance. That’s interest on interest, also known as the “snowball effect.”

3.1 The Compound Interest Formula

For compound interest, the classic formula is:

A = P × (1 + r / n)n×t

- A = the amount you’ll have in the future (ending balance)

- P = principal (starting balance)

- r = annual interest rate (decimal)

- n = number of compounding periods per year (12 for monthly, 365 for daily, 4 for quarterly, etc.)

- t = time in years

Your total interest earned is just:

Interest earned = A − P

3.2 Compound Interest Example

Let’s say you deposit $5,000 into a savings account paying a 5% interest rate, compounded monthly, for 1 year.

P = 5,000

r = 0.05

n = 12 (monthly compounding)

t = 1 year

A = 5,000 × (1 + 0.05 / 12)12×1

If you run that through a calculator, you get an ending balance around $5,255.81. Your interest for the year is about $255.81. That’s more than the $250 you’d get with simple interest at 5% on $5,000, thanks to compounding.

4. APY vs Interest Rate: Why Both Numbers Matter

Banks often show both an interest rate and an APY (Annual Percentage Yield) for savings accounts. These numbers are siblingsbut not twins.

- Interest rate: The base annual rate the bank pays on your balance. It doesn’t automatically show the effect of compounding.

- APY: The annual percentage yield, which includes compounding and shows how much you’ll actually earn in a year if the rate and compounding frequency stay the same.

For savings accounts, APY is usually slightly higher than the basic interest rate because it includes that interest-on-interest effect. When you compare savings productsespecially high-yield savings accountsuse APY as your main comparison tool.

In practice, banks do the compounding math for you and publish the APY, so you don’t have to recalculate it from scratch. But understanding that APY already bakes in compounding helps you interpret your earnings correctly.

5. Monthly and Daily Interest: How Banks Actually Do It

Many banks calculate interest on a daily basis and then pay it monthly. The process often looks like this:

- The bank takes your annual interest rate and divides it by 365 (or 360, depending on the bank’s convention) to get a daily rate.

- Each day, they multiply that daily rate by your end-of-day balance to calculate that day’s interest.

- At the end of the month, they add up all the daily interest amounts and deposit the total into your account.

That daily calculation is what makes small differences in APY add up over timeespecially when you keep adding new deposits.

6. 15 Steps to Calculate Interest on a Savings Account

Now that you’ve got the concepts, let’s put them into a practical, step-by-step process you can follow for almost any account.

Step 1: Identify your account type and APY

Check your bank dashboard or account disclosure to find the interest rate and APY. Make sure you’re looking at the savings account, not a checking account or promo ad you saw six months ago.

Step 2: Confirm the compounding frequency

Look for words like “compounded daily,” “compounded monthly,” or “compounded quarterly.” This tells you what to use for n in the compound interest formula.

Step 3: Note your starting balance (principal)

Record your balance at the start of the period you want to measuresay, the first day of the month or the first day of the year.

Step 4: Decide the time period you want to calculate

Are you trying to calculate interest for a month, six months, or a full year? Convert that into years for the formula (for example, 6 months = 0.5 years; 1 month ≈ 1/12 year).

Step 5: For a simple estimate, use the simple interest formula

When you just need a rough answer and you’re not worried about exact cents, use:

Interest ≈ P × r × t

This gives you a quick ballpark figure of what to expect.

Step 6: For a precise figure, use the compound interest formula

Plug your numbers into:

A = P × (1 + r / n)n×t

Then compute Interest = A − P. A standard calculator app or an online savings calculator makes this easier.

Step 7: Adjust for monthly contributions if you add money regularly

If you’re depositing a fixed amount every month, treat each deposit as its own mini “P” with less time to grow. For example, a deposit in January earns interest for 12 months, a deposit in February for 11 months, and so on. You can approximate the effect using an online calculator that supports “monthly contributions.”

Step 8: Check if your account has a tiered rate

Some accounts pay different rates depending on your balance (for example, one APY under $10,000 and a higher APY above $10,000). In that case, you may need to split your calculation into parts for each tier.

Step 9: Watch out for minimum balance or activity requirements

If your account requires a minimum balance or a certain number of transactions to earn the advertised APY, factor that in. If you don’t meet the requirements, the bank may drop you to a lower rate.

Step 10: Use daily rate for very accurate short-term calculations

If you want to know what you’ll earn over, say, 10 days, divide your annual rate by 365 to find the daily rate:

Daily rate = r / 365

Then: Interest ≈ Balance × Daily rate × Number of days.

Step 11: Compare high-yield savings accounts using APY, not just rate

When shopping around, focus on APY. A small differencesay 4.25% vs. 4.50% APYcan mean hundreds of dollars over several years if you’re saving larger amounts.

Step 12: Factor in inflation in your long-term planning

For long-term goals, remember that interest is earning you nominal dollars, but inflation may reduce your real purchasing power. A 5% APY feels less exciting if inflation is 4%. Your money is still growing, but slowly.

Step 13: Use online calculators for complex scenarios

If your savings plan involves multiple deposits, changing rates, or different compounding options, lean on an online savings or compound interest calculator. You’ll still understand the math, but you won’t have to do every step by hand.

Step 14: Double-check bank statements against your own estimates

Take your estimated interest for a month or quarter and compare it to what your bank actually paid. If the numbers are close, you’re on the right track. If the difference is big, review your assumptions or call the bank to ask how they calculate interest.

Step 15: Turn the math into a habit

Once you’ve done this a couple of times, it becomes second nature. You’ll start to see how bumping your APY higher, increasing your monthly contribution, or just giving your money more time can dramatically change your future balance.

7. Real-World Examples to Make It Concrete

Example A: Short-Term Savings with No Extra Deposits

You deposit $2,000 into a high-yield savings account with a 4.5% APY, compounded monthly. You leave it alone for one year.

Approximate with simple interest:

Interest ≈ 2,000 × 0.045 × 1 = 90

Estimated ending balance ≈ $2,090.

The actual compound interest calculation will give you a tiny bit more than $90, but it’ll be close enough for a quick estimate.

Example B: Adding Monthly Contributions

You start with $500 and add $100 every month to an account earning 4% APY, compounded monthly, for 2 years. Here, each monthly $100 deposit has a different “time in the account,” so manually calculating each one can get messy. This is where an online savings calculator shinesyou plug in:

- Initial deposit: $500

- Monthly contribution: $100

- APY: 4%

- Time: 2 years

- Compounding: monthly

The calculator will show your ending balance and total interest earned, separating the impact of your contributions from the interest growth.

8. Experience-Based Tips for Calculating Savings Account Interest

Math is great, but real life is where it gets interesting. Here are some experience-based lessons that come up again and again when people start tracking their savings interest.

8.1 Don’t underestimate “boring” high-yield savings

A lot of savers chase flashy investments and ignore what a steady, relatively low-risk high-yield savings account can do. When you actually calculate the interest month after month, you see that the combination of reasonable APY, compounding, and consistent deposits adds up. It doesn’t feel dramatic day to day, but checking your balance after a year is a very nice surprise.

8.2 The habit matters more than the rate (at first)

It’s easy to fixate on whether you’re getting 4.40% APY or 4.60% APY. That difference matters, especially with bigger balances, but early on your deposit habits matter more than the exact APY. Someone saving $300 per month at 4% usually beats someone saving $50 per month at 5%. Use the formulas to play with scenariosyou’ll see that consistency wins.

8.3 Manually checking one month can be eye-opening

Try this: pick a month, note your starting balance, your ending balance, and any deposits or withdrawals. Use a daily or monthly interest estimate to calculate what you think your interest should be, then compare it with what your bank actually paid. This exercise does two things:

- It makes the math feel real, not theoretical.

- It helps you catch any misunderstandings about how your bank calculates interest (for example, if they use a different day-count convention or tiered rates).

8.4 Understanding APY helps you ignore bad offers

Once you understand the difference between interest rate and APY, it’s much harder for a weak offer to impress you. A traditional savings account paying 0.10% APY becomes an obvious “no thanks” when you know high-yield accounts can pay many times that. That awareness comes from doing the math yourself at least once.

8.5 Compounding rewards patience (and punishes frequent withdrawals)

Running the numbers also shows you that compounding loves time and hates constant drain. Every time you move money out of savings for non-essentials, you’re not just lowering this month’s balanceyou’re cutting future interest earnings too. Seeing this laid out in calculations often nudges people to create a separate “fun spending” account and let their high-yield savings grow more undisturbed.

8.6 Rate changes aren’t the end of the world if your habits are solid

Savings account rates move up and down with the broader interest-rate environment. If you’re in the habit of checking APYs and occasionally switching to better options, short-term rate cuts are annoying but not catastrophic. Your steady contributions and the foundation you’ve built matter more than any one year’s APY.

8.7 Use calculations to set real goals

Instead of saying, “I guess I’ll just save what I can,” flip it around: use the formulas to figure out how much you need to save to reach a specific number. For example, “I want $10,000 in my emergency fund in three years at roughly 4% APYhow much per month do I need to contribute?” Plugging that into a calculator turns a vague wish into a plan with a monthly target.

Over time, people who regularly calculate and track interest on their savings accounts tend to feel more in control. The numbers stop being mysterious, and your account balance becomes something you actively manage, not just something you glance at every once in a while.

9. Conclusion: Turn Your Savings Math into Money Power

Learning how to calculate interest on a savings account isn’t just about formulasit’s about understanding how your money grows and how to speed that growth up. Simple interest shows you the basics, compound interest shows you the power of time, and APY combines everything into one easy-to-compare number. Once you know how to plug in principal, rate, time, and compounding frequency, you can forecast your savings, compare accounts with confidence, and set realistic goals.

The next time your bank credits your account with interest, you’ll know exactly where that number comes fromand how to make it bigger.

SEO Summary Block

sapo: Curious how your bank decides how much interest to pay you each month? This in-depth guide breaks down how to calculate interest on a savings account using simple and compound interest formulas, explains the difference between interest rate and APY, and shows you step-by-step how to estimate your earnings with real-world examples. Whether you’re comparing high-yield savings accounts or planning your emergency fund, you’ll learn the math, the strategy, and practical tips to turn your savings into a powerful money tool.