Product-led growth (PLG) has a reputation for being “sales-free.” Which is a bit like saying a self-checkout lane

means the store fired every cashier, locked the doors, and now communicates only via QR code.

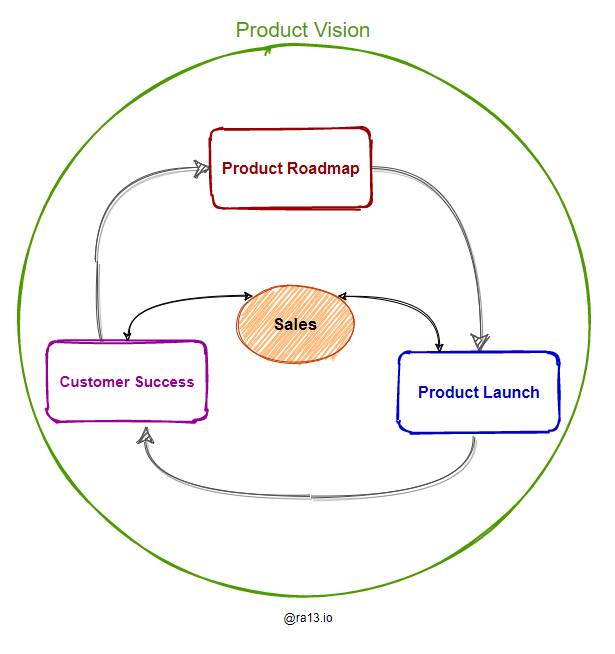

In reality, PLG changes when sales shows up, why sales shows up, and what sales does once it gets there.

The product becomes the front door; sales becomes the renovation crew that helps bigger customers move in comfortably,

safely, andmost importantlyat a higher monthly rent.

Here’s the twist: the more PLG works, the more likely you are to need sales. Not for the old-school job of “explaining

what the product does,” but for the grown-up work of navigating procurement, aligning stakeholders, solving risk and

compliance concerns, packaging value, and expanding usage across an organization. PLG doesn’t delete salesit upgrades sales.

What “Product-Led Growth” Actually Means (and What It Doesn’t)

PLG is a go-to-market approach where the product experience drives acquisition, activation, conversion, retention,

and expansion. Instead of starting with a demo request, buyers often start with a free trial, freemium plan, or

self-serve onboarding. The product is the primary “marketing channel” because it demonstrates value directly in a user’s hands.

What PLG doesn’t mean: “Sales is obsolete.” Even Gartner’s research has repeatedly highlighted that many buyers

prefer to do a lot on their own digitally, but still want seller input for certain high-context decisionsespecially when it’s time

to determine fit, reduce risk, or justify a purchase internally. In other words, buyers often want less selling and more help.

Why Sales Still Matters in a PLG World

In traditional sales-led growth, sales creates demand through outbound and high-touch demos. In PLG, demand is often created

by the product itselfthrough bottom-up adoptionwhile sales focuses on accelerating the “messy middle”:

multi-user rollout, security review, legal redlines, budget approval, and executive alignment.

Three forces that make sales essential (even in PLG)

- Complexity: Larger accounts require procurement, compliance, integrations, and stakeholder alignment.

- Risk management: Security questionnaires, data residency, SSO/SAML, and vendor reviews don’t complete themselves.

- Expansion economics: Many SaaS businesses win long-term via retention and expansion; sales can drive multi-team rollout and upgrades.

McKinsey and other operators point out that product usage data can change how sales qualifies and prioritizes leads:

instead of chasing pure “interest,” sales can focus on accounts that have already experienced value via trial or freemium.

That’s the core shift: sales moves from persuasion to prioritization and orchestration.

Meet the PLG-Friendly Sales Team: What Sales Does Differently

In a PLG motion, sales isn’t the opening actit’s the headliner that comes on after the crowd already loves the band.

The best PLG sales teams use product signals to decide who to engage, when to engage, and how to add value.

Many teams call this “product-led sales” (PLS): a sales motion layered on top of PLG that uses in-product engagement and usage

data to drive conversions and expansions.

1) Turning usage into pipeline (hello, PQLs and PQAs)

PLG replaces (or supplements) marketing-qualified leads (MQLs) with product-qualified leads (PQLs) and

product-qualified accounts (PQAs)users or accounts showing meaningful usage signals that correlate with buying intent.

Think: multiple active users, repeated usage of a “sticky” feature, hitting a usage cap, inviting teammates, or attempting an admin-only capability.

A practical PQL definition is never “signed up.” It’s “reached an ‘aha’ moment and is now bumping into real constraints.”

For example:

- Invited 5+ teammates and created 3+ projects in the first week

- Connected a critical integration (e.g., Slack, Salesforce, GitHub)

- Attempted SSO/SAML setup or admin controls

- Usage trending upward week-over-week inside one domain/company

2) Sales-assisted conversion (helping buyers buy)

In PLG, a big portion of customers can convert self-servegreat. But “bigger” customers often need help:

pricing and packaging clarity, security documentation, implementation planning, stakeholder education, and contract workflow.

Sales becomes the guide who helps customers make a confident decision without turning the process into a never-ending demo marathon.

The tone matters. Gartner’s buyer research has also warned that irrelevant outreach is actively avoided by buyers.

So the PLG sales approach is: be precise, be contextual, and be useful. When a user is clearly succeeding, don’t interrupt with

“Want a demo?” Offer something they can’t get from the product alonelike rollout design, ROI framing, or governance best practices.

3) Expansion and upsell (sales as a multiplier, not a gatekeeper)

Mature PLG companies often win by expanding within accountsmore seats, more teams, higher tiers, and more use cases.

That’s not just “upselling”; it’s helping the customer operationalize the product across the org.

Expansion selling in PLG is typically triggered by product signals: adoption across multiple teams, feature demand,

admin requests, or clear value realization that justifies a broader rollout.

The Five Most Common Sales Motions in PLG

PLG sales isn’t one motionit’s a set of motions chosen based on customer segment, product complexity, and buying friction.

Common patterns include:

1) Inbound conversion (self-serve → assisted)

A user starts with freemium or trial. Sales engages only when usage signals suggest real intent or when a user requests help.

This motion tends to be efficient because sales isn’t creating interest from scratch; they’re converting demonstrated value.

2) Product-triggered outreach (PQL/PQA → sales touch)

Sales (often SDR/BDR or a growth-oriented AE) reaches out based on product analytics: “I noticed your team has 12 active users and

you’re running into permission constraintswant help setting up workspace governance and the right plan?”

The product becomes the reason for the conversation, not a generic pitch.

3) Reverse trial (paid-first with guided activation)

Some companies flip the sequence: they sell a plan, then guide activation hard to ensure value realization fast.

This works best when customers already understand the problem and want speed, but still need support to implement well.

4) Enterprise “top-down” overlay (bottom-up adoption → exec alignment)

Bottom-up adoption can open doors, but enterprise deals often require a top-down layer:

security approval, procurement, budget, legal, and executive sponsorship. This is where sales leadership, account strategy,

and stakeholder mapping matter most. A16z has written about the culture clash that can happen when top-down sales enters a product-led company

and how success depends on respecting the product-first ethos while building the operational muscle to sell bigger contracts.

5) Expansion-first selling (land small → grow big)

PLG can land a small team quickly. Sales then works with champions and admins to expand use cases, move from team to department,

and standardize across the org. This motion thrives when product instrumentation makes expansion opportunities obvious and timely.

What Great PLG Sales Looks Like in Practice

Sales becomes a product partner (not a product narrator)

In high-functioning PLG companies, sales teams collaborate with product, growth, and customer success to improve onboarding,

reduce time-to-value, and remove friction that blocks conversion. They share objections and patterns (“Teams stall at admin setup”),

not just anecdotes (“Prospects hate our pricing page,” although… fair).

Sales works from evidence, not vibes

Product usage is the new qualification layer. Salesforce and others describe product-led sales as leveraging trial/freemium usage data

to prioritize high-intent opportunities and reduce time wasted nurturing low-fit leads. This is why PLG teams invest heavily in:

event tracking, account matching, identity resolution, lead routing, and lifecycle automation.

Sales is tightly aligned with RevOps (or regrets follow)

PLG data is only powerful if it’s operationalized. RevOps (and sometimes a dedicated Growth Ops function) sets definitions,

pipelines, routing rules, SLAs, and dashboards so “PQL” means the same thing across teams.

Without that, the org devolves into debates like: “Is this a PQL?” “Well, it feels like a PQL.” “Congrats, you’ve invented astrology.”

Metrics That Matter: How to Measure Sales Impact in PLG

PLG doesn’t remove the need for revenue metricsit adds product metrics that explain why revenue is moving.

A healthy scorecard mixes:

- Activation rate (did users reach the “aha” moment?)

- Time-to-value (TTV) (how fast did they get value?)

- PQL/PQA volume and conversion (how many product-qualified opportunities convert?)

- Free-to-paid conversion rate (self-serve and sales-assisted)

- Sales cycle length (especially for PQL-driven opportunities)

- Expansion revenue (upsell/cross-sell driven by adoption signals)

- Net revenue retention (NRR) (the ultimate “product + sales + CS” report card)

Common Mistakes When Adding Sales to PLG (and How to Avoid Them)

Mistake 1: Treating PQLs like MQLs

A PQL is not “someone who exists.” It’s someone who has experienced value and shown intent. If your PQL criteria are too broad,

sales gets flooded, response times drop, and outreach becomes irrelevantthe exact behavior buyers increasingly avoid.

Fix it by tightening criteria, scoring intent signals, and continuously validating what converts.

Mistake 2: Calling every active user immediately

Not every user wants (or needs) a human. Many are happily self-serve. The job is to identify when a human accelerates value:

admin setup, security review, org rollout, pricing guidance, or complex integration. Outreach should feel like help, not interruption.

Mistake 3: Letting sales override the product (culture crash)

Introducing top-down sales into a product-led org can create friction if incentives and culture aren’t aligned.

The goal is not to “turn PLG into old-school enterprise sales.” The goal is to keep the product as the primary value engine,

while building a sales motion that supports bigger, more complex buyers without breaking the user experience.

Mistake 4: Not building a real handoff between product, sales, and CS

PLG customers often move fluidly between self-serve and assisted. If teams operate in silos, customers feel it:

repeated questions, inconsistent messaging, and slow responses. Build shared definitions, shared dashboards,

and clear “who owns what” rules for trial, conversion, onboarding, and expansion.

A Simple Playbook: How to Layer Sales on Top of PLG

- Instrument product usage: Track events that reflect activation, habit, and constraint (the “why now”).

- Define PQL/PQA: Agree on the signals that predict buying intent and validate them with conversion data.

- Route intelligently: Send high-intent accounts to sales; keep low-friction users in self-serve nurture.

- Train for “help,” not “pitch”: Talk governance, rollout, ROI, security, and stakeholder alignment.

- Design offers for the moment: Trials, annual plans, admin packs, or enterprise add-ons that remove blockers.

- Close the loop: Feed objections and friction back to product and growth teams to improve the experience.

So, What’s the Role of Sales in Product-Led Growth?

Sales in PLG is the team that scales outcomes when self-serve hits natural limits. It converts usage into revenue,

turns champions into org-wide rollouts, and helps buyers navigate complexity without killing momentum.

Done well, sales doesn’t compete with PLGit amplifies it.

If PLG is the engine, sales is the transmission. The engine can rev all day, but eventually you’ll want to move

from “a few happy users” to “a company-wide standard.” That’s where product-led sales earns its keepquietly,

efficiently, and without making the user feel like they accidentally clicked “Request a Demo” in 48-point font.

Experience Section (Extra ~): What Sales in PLG Feels Like on the Ground

The strangest part of selling in a product-led company is that your best “cold call” is often… not cold. You’re not starting with,

“Hi, do you have a problem I can describe to you?” You’re starting with, “Hi, you’re already using the producthow can I make this easier

to scale?” That shift changes everything: your tone, your timing, and your credibility.

One of the most effective moments to reach out is when a team hits a constraint that signals seriousness. It might be a limit

(“You’ve reached 3 dashboards”), an admin action (“Someone tried to set up SSO”), or a pattern (“Usage just doubled two weeks in a row”).

In a PLG motion, those aren’t just analytics; they’re context. And context is what makes a sales message feel relevant instead of spammy.

The rep who understands why the team is growing can offer something specific: “Want help rolling this out to your second department?”

beats “Circling back!” every day of the week and twice on Mondays.

Another real-world learning: sales has to get comfortable with small beginnings. PLG lands a lot of deals that start modestly.

A traditional sales org might see that and panic (“The ACV is tiny!”). A PLG-savvy sales org sees it as a foothold:

a real champion, real usage, and real proof the product works. The job is to help that champion win internallyby packaging the story.

Not a fluffy story, but a crisp one: what changed, what value was created, what risks are reduced by standardizing, and what happens next.

When you bring that kind of narrative to procurement and leadership, you turn “tool a few people like” into “platform we can trust.”

Collaboration is also less optional than it looks on org charts. The best PLG sales reps I’ve seen operate like translators:

they translate customer constraints into product feedback (“Teams stall when admin setup is unclear”), and translate product capabilities

into rollout plans (“Here’s the governance model that fits your org”). They partner closely with growth and product teams because

every friction point is a revenue leak. A confusing permission model isn’t just “UX debt”; it’s “lost expansions.”

Finally, there’s a humbling lesson that shows up repeatedly: in PLG, the customer’s experience is the pitch.

If onboarding is clunky, sales can’t “out-charm” it forever. If time-to-value is slow, the deal pipeline gets weird and wobbly.

That’s why PLG sales tends to be honestsometimes painfully so. When a prospect asks, “Can you do X?”, the best answer may be,

“Not yet, but here’s the workaround, here’s the roadmap, and here’s what other customers do today.” Trust compounds faster than hype.

When sales in PLG is working, it’s almost invisible. Customers feel like they’re being guided, not pushed.

They keep their momentum, they get real help removing blockers, and the product’s organic adoption turns into durable revenue.

And the sales team? They stop “convincing” and start coachingwhich, ironically, tends to close bigger deals.