If you feel like everyone who bought a house in 2021 had a perfect 800+ credit score and a

halo, you’re not imagining it. During the pandemic housing boom, lenders got very picky.

Median credit scores on new mortgages climbed into the stratosphere, and anyone with a few

dings on their report was told to “try again later.”

Fast-forward to today: Mortgage rates are still high, prices haven’t exactly crashed, and yet

something important is shifting. The average credit score on newly approved mortgages has

been easing back from those peak levels. We’re not talking about a wild return to 2006-style

subprime chaos, but the data show a slow, noticeable move toward including more borrowers

with “good” rather than “perfect” credit.

In this article, we’ll unpack what’s really going on with mortgage credit scores, why the

average for approved loans is drifting down, and what that means if you’re trying to buy a

home with a score that’s less than brag-worthy.

From Ultra-Prime to Just Plain Strong: How We Got Here

The pandemic era: lenders only wanted A+ students

After the 2008 housing crash, lenders tightened up credit standards and slowly rebuilt

discipline. Then came the pandemic. Rock-bottom rates and remote-work demand created a

tidal wave of mortgage applications. To manage the risk and the volume, lenders leaned

heavily toward borrowers with very high credit scores.

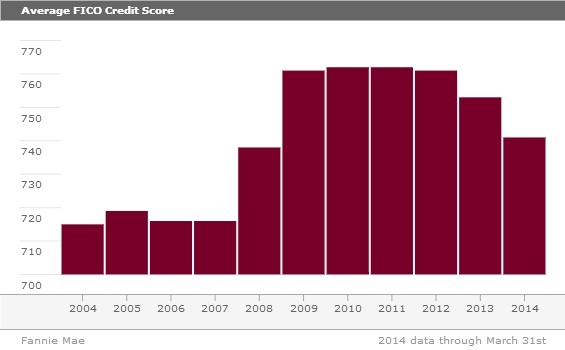

Federal Reserve Bank of New York data show that by the early 2020s, the median credit score

on newly originated mortgages had moved well into the 760–770 range, much higher than in

the mid-2000s. At one point, more than two-thirds of new mortgages went to borrowers with

scores above 760, and the share of loans to borrowers below 620 was around 2%a tiny

fraction of what it was before the financial crisis.

In plain English: If your credit score wasn’t excellent, you were usually out of luck. This

pushed the “average” and “median” scores on approved mortgages to unusually high levels.

The slow slide from the peak

As the economy reopened and the initial pandemic shock faded, those hyper-elevated credit

standards began to normalize. New York Fed reports show that the median credit score on

newly originated mortgages slipped a bit from its pandemic heights into the mid-760s and

then hovered around the high-760s to roughly 770. That’s still very strong, but directionally

it’s a soft drift downward rather than a continued climb.

Other data sets tell a similar story. Government and industry statistics show a modest

increase in the share of mortgage volume going to borrowers in the “good but not stellar”

credit tiers. While super-prime borrowers (roughly 720–760+) still dominate, the share of

subprime and near-prime borrowers has inched up from rock-bottom levels seen right after

the pandemic.

So, the average credit score for approved mortgages is not crashing, but it is easing off the

“only perfect people need apply” standard of a few years ago.

Why the Average Score Is Declining (Without a Return to 2008)

1. Lenders need business, not just pristine credit files

The mortgage industry lives on volume. When rates soared from their historic lows, refinance

activity collapsed and purchase demand cooled. Lenders still want to make loans, and one way

to do that is by widening the credit box slightlyapproving more borrowers with scores in

the 660–719 range, as long as other aspects of the application look solid.

That shift naturally pulls the average approved credit score down a bit. You can think of it

as going from a class where everyone is an A student to a class with mostly As and Bs.

The average drops, but overall performance is still strong.

2. Strong equity and underwriting allow more flexibility

One big difference from the pre-2008 era is the amount of equity households hold and the

quality of underwriting. Homeowners today generally have more equity and less risky loan

products (fewer interest-only and negative-amortization loans, for example). That gives

lenders confidence to take on borrowers who might have a 690 or 700 score instead of 760,

as long as the income, debt-to-income ratio, and loan-to-value (LTV) look responsible.

In other words, lenders don’t need every borrower to have a flawless credit report if the

overall loan profile is healthy. That kind of risk layeringbalancing a slightly lower score

with a bigger down payment or lower DTInudges the average credit score down while

keeping default risk controlled.

3. New credit scoring models are bringing more people into the fold

Another important driver is the transition to updated credit scoring models, such as

VantageScore 4.0 and newer FICO versions, which consider things like rental and utility

payments. These models can generate scores for millions of borrowers who previously

didn’t have enough traditional credit history to be scored at all.

When more “thin-file” and previously “invisible” consumers suddenly become scoreable,

they don’t all show up with 780 scores. Many land in the 620–700 range. As lenders adopt

these models and regulators allow their use for agency-backed mortgages, the pool of

approved borrowers broadens and, again, the average score drifts down even if risk is

well managed.

4. Government-backed and affordable-housing programs matter

FHA, VA, and USDA loans have long allowed lower credit scores compared with conventional

conforming loans. As affordability challenges growthanks to high prices, higher rates,

and rising insurance coststhese programs play an even bigger role in helping first-time and

lower-income buyers get in the door.

When a larger share of total mortgage volume comes through channels that tolerate lower

credit scores (while still verifying income and ability to repay), the combined “average” score

across all approved mortgages naturally trends lower.

What This Means If You’re Shopping for a Mortgage

You don’t need an 800+ credit score to get approved

Let’s start with the good news: You no longer need to be a credit unicorn to get a mortgage.

Many approved borrowers today fall into the “good” but not “elite” credit range. Depending

on the program, borrowers with scores in the high 600s or low 700s may qualify, especially if

they have:

- A stable, documented income

- A reasonable debt-to-income ratio (often under 43%, sometimes lower for riskier profiles)

- A manageable loan-to-value ratio (for example, making a 10–20% down payment)

- Some cash reserves after closing

In practice, that means buyers who felt locked out a few years ago may now have a realistic

shotparticularly if they’re open to FHA, VA, or other government-backed options.

The trade-off: You’ll still pay more for a lower score

Before you celebrate with a shopping spree on new furniture, there’s a catch. While the bar

for approval is lower than it was at the height of the pandemic boom, pricing is still very

sensitive to credit scores.

On a conventional loan, the difference between a 760 score and a 680 score can mean a

noticeably higher interest rate or added fees through loan-level price adjustments. Over the

life of a 30-year mortgage, that can translate into tens of thousands of dollars in extra

interest. Lower scores may also require mortgage insurance for longer, or at higher premiums.

So yes, average credit scores for approved mortgages are decliningbut it still pays

handsomely to push your own score as high as you realistically can before you apply.

Who benefits the most from this shift?

The borrowers most helped by this trend are those who:

- Have stable incomes and modest debt, but only “okay” credit scores in the mid-600s

- Lack a long credit history but have strong rental and bill-payment records

- Are using affordable-housing or down-payment-assistance programs

- Are willing to consider FHA or VA loans instead of insisting on conventional only

If you’re in that group, the slowly declining average credit score on approved mortgages is

not a red flagit’s your opportunity.

How to Position Yourself in a Market With Easing Credit Scores

Step 1: Know your starting point

Before you talk to a lender, check your credit scores from the major bureaus and review your

full credit reports for errors. Dispute any incorrect late payments or accounts that don’t

belong to you, and make sure your personal information is up to date.

If you’re close to a key thresholdsay 679 vs. 680, or 699 vs. 700it may be worth delaying

your application a few months to nudge yourself into a better pricing tier.

Step 2: Strengthen the other legs of your application

Because lenders look at the whole picture, you can often offset a less-than-perfect score by

polishing other parts of your profile:

- Pay down revolving credit to lower your utilization ratio

- Avoid taking on new loans or big purchases before applying

- Increase your down payment if possible

- Show consistent rent payments (which some lenders can now factor in more easily)

Think of it as building a case for yourself: “My score isn’t 780, but I’m low-risk in other

ways.”

Step 3: Match the loan type to your profile

Don’t assume a conventional 30-year fixed is your onlyor bestoption. FHA loans may accept

lower scores with competitive rates but add mortgage insurance. VA loans can be extremely

attractive for eligible borrowers, especially with modest scores but strong service history

and income. Some state and local programs also offer flexible credit guidelines in exchange

for education courses or occupancy requirements.

Because the average credit score for approved mortgages is drifting down, more lenders are

tailoring products to meet borrowers where they are. A good loan officer will help you

navigate that menu, not just push you into a one-size-fits-all product.

Real-World Experiences: What Borrowers Are Seeing on the Ground

Statistics are great, but what does this look like in real life? Here are a few composite

“storylines” based on common scenarios that illustrate how declining average scores are

showing up in the mortgage market.

The “late bloomer” renter

Imagine Maya, a long-time renter with a 675 credit score. She’s never missed a rent payment,

but she’s had a couple of late credit-card payments and only a modest credit history. A few

years ago, that 675 might have put her on the edge of approval or forced her into a much

smaller price range than she wanted.

Today, with lenders increasingly able to consider rental payment data and with slightly

broader credit boxes, Maya’s application looks different. Her lender can document her

flawless rent history, see that her overall debt is moderate, and approve her for an FHA loan

with a manageable down payment. Her score isn’t suddenly elite, but the changing landscape

turns “no way” into “yes, with conditions.”

The self-employed buyer with a thin file

Then there’s Jordan, a self-employed graphic designer who mostly uses debit and rarely

carries a credit-card balance. For years, Jordan’s biggest problem wasn’t “bad credit” but

“no credit”there simply wasn’t enough data for traditional models to score confidently.

As newer scoring methods incorporate things like consistent on-time utility payments and

rental history, Jordan finally gets a solid mid-600s score. A few years back, that might have

been a dead end. But in today’s environmentwhere lenders are trying to serve more

diverse profiles while still underwriting carefullyJordan can pair that score with strong

tax documentation and a larger down payment to secure an approval.

The couple who thought they had to wait five more years

Finally, consider a couple, Sam and Alex, who spent most of their twenties paying down

student loans and cleaning up from a couple of youthful financial mistakes. Their combined

score is around 705. For years, they believed the “you need at least a 740” myth and assumed

homeownership was a far-off dream.

As they start talking to lenders in the current market, they’re surprised to learn that many

borrowers are being approved with scores similar to theirsespecially if they keep their

other debts low and can swing a reasonable down payment. The rate they get isn’t as low as

it would be with a 780 score, but it’s not punitive, and they’re able to buy a starter home

sooner than expected.

These stories share a common theme: The gradual decline in average approved credit scores

is widening the door for borrowers who are financially stable but imperfect on paper. It

doesn’t mean anyone with a pulse gets a loan, and it doesn’t mean responsible preparation

doesn’t matter. What it does mean is that “good enough” credit, paired with solid overall

finances, is finally living up to its name.

If your credit score isn’t where you ultimately want it to be, that’s not a reason to panic

it’s a reason to plan. The modern mortgage market is still cautious, but it’s more nuanced,

more data-driven, and slowly more inclusive than the ultra-prime days at the height of the

pandemic boom.

Conclusion

The headline “The Average Credit Score For Approved Mortgages Is Declining” might sound

scary, but context matters. We’re coming down from an unusually high peak, not plunging

into a free-for-all. Lenders are still careful, underwriting is still significantly stronger than

it was before 2008, and most new mortgages still go to borrowers with solid, if not stellar,

credit.

For would-be buyers, this shift is more opportunity than danger. You may not need to hit an

800 score to get a fair shot at homeownershipbut you’ll still be rewarded for improving

your credit profile and strengthening the rest of your financial picture. Think of today’s

mortgage market as “grown-up flexible”: open to more types of borrowers, but not willing to

ignore the math.

SEO Summary

-

meta_title:

The Average Credit Score For Approved Mortgages Is Declining -

meta_description:

Learn why average credit scores on approved mortgages are easing down, what it means for buyers, and how to qualify with less-than-perfect credit. -

sapo:

Average credit scores on approved mortgages are quietly drifting lowernot because lenders are reckless again, but because the market is finally easing off pandemic-era, ultra-strict standards. Updated credit scoring models, strong homeowner equity, and the growing role of FHA, VA, and affordable-housing programs are allowing more “good” rather than “perfect” borrowers to qualify. This in-depth guide explains what the trend really looks like in the data, why it’s happening, and how to position yourself for approval even if your score isn’t in the 800s. If you’ve been putting off homeownership because you thought your credit wasn’t good enough, this is your playbook. -

keywords:

average credit score for approved mortgages; mortgage credit score trends; declining credit score mortgage approvals; minimum credit score for mortgage; mortgage lending standards; FHA and VA loan credit scores; VantageScore 4.0 mortgage impact